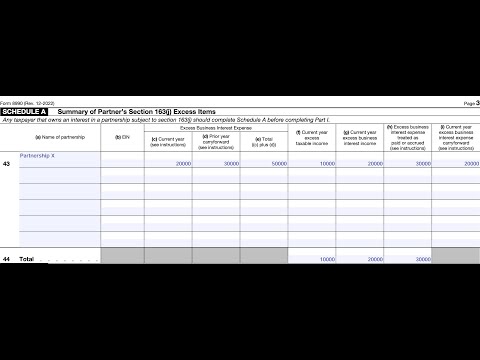

So we're going to be going over IRS form 8990 schedule a at the request of someone who watched our review of form 89.90 and specifically as for a deep dive on schedule a as it pertains to Partnerships under common control subject to six Section 163 J limitations so before we go into the schedule itself I figured I'd share a couple of things that are worth noting if Section 163 J limitations apply to your partnership so first there are there the IRS has an FAQ page about limitations on the deductions for business interest expense and there are a lot of questions that the IRS has already answered on their FAQ I want to point that out just in case there's a question that you might have that the IRS website has already taken care of um two a couple of things when you should file schedule a so it's important to note that any taxpayer that's required to complete part one and is a partner in a partnership subject to section 163j limitation must complete schedule a before completing part one so the information in schedule a informs certain lines in part one that we'll get to so when we get to line 43 we will be taking certain information uh basically the excess business interest expense that is column C current year excess taxable income from common math and then excess business interest income in column G are all items that should be reported to the partner on schedule K1 so you're going to need schedule K1 to build schedule a so with that let's go into the form itself so you'll see columns a through I and column A is the name of the partnership there are several lines in case there are more...

Award-winning PDF software

How to prepare Form 8918

About Form 8918

Form 8918 is used by taxpayers to disclose transactions or positions which are identified as potentially being abusive tax avoidance transactions (ATATs). These transactions may have a significant impact on the taxpayer's tax liability. ATATs are those transactions that involve the use of unnecessary steps to obtain tax benefits, without having a substantial purpose other than tax avoidance. The Internal Revenue Service (IRS) considers these transactions to be potential tax shelters, and reporting them through Form 8918 is a compliance requirement. Taxpayers, including individuals, corporations, partnerships, trusts, or estates, who have participated in or are involved in ATATs must complete and file Form 8918. This form provides detailed information about the transaction, its tax implications, and the taxpayer's involvement in it. It is important to note that filing Form 8918 does not necessarily mean that the transaction is deemed to be an abusive tax avoidance transaction. However, it serves as a disclosure mechanism for taxpayers to be transparent about their participation in potentially questionable transactions, ensuring compliance with the tax laws and regulations enforced by the IRS.

What Is Form 8918

Online technologies make it easier to organize your file management and boost the productivity of your workflow. Observe the brief manual as a way to fill out Irs Form 8918, prevent mistakes and furnish it in a timely manner:

How to complete a Form 8918 online:

-

On the website with the form, click Start Now and go for the editor.

-

Use the clues to fill out the applicable fields.

-

Include your personal information and contact data.

-

Make absolutely sure that you choose to enter appropriate details and numbers in correct fields.

-

Carefully check the data of your blank as well as grammar and spelling.

-

Refer to Help section when you have any concerns or contact our Support staff.

-

Put an electronic signature on your Form 8918 printable while using the assistance of Sign Tool.

-

Once the form is finished, click Done.

-

Distribute the prepared document through email or fax, print it out or save on your gadget.

PDF editor makes it possible for you to make improvements towards your Form 8918 Fill Online from any internet linked gadget, personalize it based on your needs, sign it electronically and distribute in several ways.

What people say about us

The best way to submit templates without mistakes

Video instructions and help with filling out and completing Form 8918