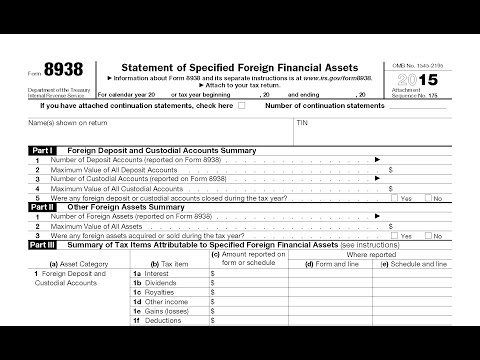

Form 8938 is a form that needs to be filed by US citizens and US resident individuals who have foreign financial assets. Those individuals generally must attach form 8938 to their US tax return, but only if the value of all the foreign financial assets exceed certain thresholds. The threshold is $50,000 for single individuals and $100,000 for spouses filing jointly, and the thresholds for both of those categories are doubled if you live outside the United States. Currently, only individuals need to file form 8938, but the IRS anticipates making it required for domestic entities as well. There is a $10,000 penalty if you're required to file form 8938 and you fail to file it. If there is any doubt as to whether the form needs to be filed, I typically go ahead and file it. There is no penalty for filing the form if you do not need to file it. Typically, if you do need to file form 8938, you also need to file FinCEN form 1 1 4, otherwise known as the eff bar. On the form, you fill out your name and your taxpayer identification number, typically a social security number. You list on line 1 the number of the accounts reported on the form, the maximum value of all deposit accounts reported on the form, and the number of all custodial accounts reported on the form. Custodial accounts are typically stock brokerage accounts. Then, on line 4, you list the value of all the custodial accounts. On line 5, you list whether any of the foreign deposit or custodial accounts closed during the tax year. If yes, you click yes; otherwise, you click no. In part 2, on line 1, you list the number of the foreign assets reported. On line 2, you list...

Award-winning PDF software

8938 Form: What You Should Know

The report is not a report of financial assets as such, but rather it is a report of reported foreign financial assets which exceed certain limits. An Expat Tax Account A FATWA account is more than just a bank account; it is an “account” that is separate from a bank account. The FATWA account may be an account in the form of a brokerage business that is a mutual fund, trust or mutual fund investment company, a brokerage account that is separate from the person's financial assets and assets held outside the account, and/or an individual account for a person that is not an expat to which the FAR only applies. This is a FATWA account, but you only need to report to the Financial Crimes Enforcement Network (Fin CEN) if you hold such an account. FATWA is different from a bank account because it is not a checking account, such as a savings account that holds your salary, that is used for cash withdrawals and ATM fees. The FATWA Account Report Only Takes One Form: A Letter. The letter is a standard form of the IRS that summarizes the nature of the account and is required to be filed annually There are also several other tax forms and instructions that have to be filed annually. The first step involved in filing for a FAR (Reportable Bank Account) is to file Form 3921 (B) with the IRS along with a Form 8938 (Report of Specified Foreign Financial Assets.) The Tax Law FAQs on this subject explains the details. This is a new form for expats, but since many expats have opened an account in the past it was probably more useful. It states that your financial account will meet all the following FAR requirements: (a) Is of a type that (and is established or maintained) for the purpose of effecting transactions between the United States and such foreign country; and (b) Maintains, at the time on which the account is started or such later date as provided in Regulations section 301.6701-1(a)(1)(D), at least three accounts that are “unreportable accounts.” Some expats will even prefer to use either a bank account (FATWA) or an IRA (i.e. tax-exempt).

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8918, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8918 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8918 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8918 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8938