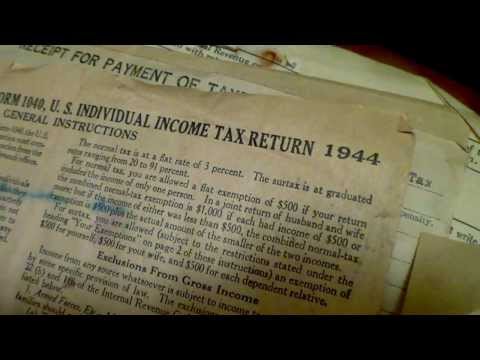

Here's the instructions for form 1040 US income tax for 1944. Now, what do we have? We've got one page, two pages, three pages, four pages, and that includes the tax schedule. So, I think we've kind of gotten to be a little bit longer today than in 1944. Now, here's information from 1943 which is a computation of estimating income in the victory tax for 1943. It's interesting that there's a victory Tax Forum, which I've never heard of before. But that's what's cool about YouTube - you discover new things. Returning to the 1944 form, it's interesting to see how here you go, the Armed Forces must pay the tax according to the table in here. Not over two thousand, twenty percent; at ten thousand, twenty-six hundred, thirty-eight percent; and the access it's got miscellaneous medical losses and fires shipwreck for theft. It's interesting how things have gotten so complicated over time.

Award-winning PDF software

8886 instructions 2025 Form: What You Should Know

Reporting a reportable transaction should satisfy the conditions of IRS Guidance on Business Participation, which was issued on October 18, 2015. Use Form 8886, Reportable Transaction Disclosure Statement, when applicable. The primary purpose of form 8886 is to enable the taxpayer to report the types of non-reportable transactions. Also, the IRS is legally obligated to report a reportable transaction if the taxpayer fails to disclose certain information on his or her tax return. What is a Reportable Transaction? Form 8886 discusses transactions in which the taxpayer engaged in substantial business activity. Business activity does not include ordinary activities that the taxpayer conducts for personal profit. Examples of reportable transactions may include the following: Payments of income taxes to the IRS Payments of excise tax to the IRS Purchase of property or services that is used primarily to provide an investment or other investment opportunity Interest on certain savings bonds Tax deductible expenses The following are some examples of reportable transaction types: Payment of taxes to the IRS Amounts received from third party sources like insurance carriers, banks and financial institutions Payments of income taxes to the IRS Payments of excise tax to the IRS Purchase of property or services that are used primarily to provide an investment or other investment opportunity Interest on certain savings bonds The following are some additional examples of reportable transactions, as well as examples of how the information to be disclosed may be different. Payments of income taxes to the IRS Payments of excise tax to the IRS Purchase of property or services that are used primarily to provide an investment or other investment opportunity Payments of income taxes to a third party payment of excise tax to a third party Purchase of property or services that are used primarily to provide an investment or other investment opportunity Interest on certain savings bonds How to file Form 8886. See the Instructions for Form 8886, Reportable Transaction Disclosure Statement, for the specifics around filing Form 8886. When filing Form 8886, provide the filer's name, the number of the reportable transaction, the dollar amount to be reported and the taxpayer identification number (PIN) number. (Some filers may be required to include additional information, including Social Security Number, for each reportable transaction.) How to identify whether a reportable transaction involves capital gains or losses. If one or more transactions have resulted in capital gains or losses, provide the capital gains or losses from each transaction.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8918, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8918 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8918 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8918 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8886 instructions 2025